bitFlyer Crypto CFD User Guide

1. Trading Days and Times

(1) Trading days

bitFlyer Crypto CFD trades can be made, as a rule, every day.

(2) Trading and order reception hours

bitFlyer Crypto CFD trades can be made during the following times:

24 hours/day, 365 days/year

- Excludes periodic and irregular maintenance. More information on periodic maintenance can be found here.

- Periodic maintenance is scheduled to occur every day from around 4:00 AM to 4:10 AM. The start and end times are subject to change.

2. Order times

Orders are received 24 hours a day, 365 days a year. System maintenance times are excluded.

3. Order Validity Period

If no order expiration date is specified, the order will be valid for 30 days. (This does not apply if an expiration date shorter than 30 days is set using the bitFlyer Lightning API.) However, orders may be withdrawn due to factors such as service updates.

4. Leverage points

Leverage point payments occur each time a rollover is conducted and the positions that were not offset by an opposing order by 6:00 pm (JST) within the same business day of bitFlyer are extended to 6:00 pm (JST) of the next business day.

| Buy positions |

The total of (the absolute value of open positions x 0.04% per day) * The total value of open positions is calculated by multiplying the total volume of open positions the customer holds by the last traded price of bitFlyer Crypto CFD as of 6:00PM Japan time. |

| Sell positions |

- This refers to the process undertaken on each business day when positions held by the customer on bitFlyer Crypto CFD reach their expiration at 6:00 pm (JST). The process extends the expiration of these positions to the next business day at 6:00 pm (JST), after conducting the following procedures: At the time of expiration of the position, the transaction amount is recalculated based on the most recent spot trading price established on Lightning Spot, and it is confirmed that the customer has provided the necessary amount of margin to continue holding the position.

For more information, please refer to the Fees and Taxes page.

5. Margin deposit

In order to trade on bitFlyer Crypto CFD, customers are required to make a margin deposit into the corresponding bitFlyer Crypto CFD account in advance. The Company accepts Japanese Yen as fiat currency and Bitcoin as a crypto asset in lieu of a margin deposit of Japanese Yen from customers. The margin can be deposited by transferring the Japanese Yen or Bitcoin balance in the customer's bitFlyer account. For bitFlyer Crypto CFD, the Company regularly confirms the status of customers' margin deposits.

If the maintenance margin rate falls below a certain standard, and meets the predetermined criteria, the Maintenance Margin Rules, Margin Call Rules, and Sell Out Rules will apply.

- Margin rate may be changed at the Company's discretion.

- The margin rate of corporate accounts is calculated based on the assumed crypto assets risk ratio and fluctuates on a weekly basis. The leverage fluctuation will be released on our website every week. Please refer to our website for more details. (The assumed crypto asset risk ratio is calculated by the Commissioner of the Financial Services Agency. The method uses the ratio of the risk from price fluctuations that occur in the crypto asset market to the principal amount.)

- For details on the margin calculation method, please refer to "What is bitFlyer Crypto CFD?" page.

6. Funding rate

The funding rate is introduced on bitFlyer Crypto CFD with the aim of preventing a divergence between the trading price on bitFlyer Crypto CFD and the trading price on Lightning Spot (BTC/JPY).

The definition of the funding rate for bitFlyer Crypto CFD is as follows:

-

A mechanism whereby the amount calculated based on the difference between the following two prices is exchanged between holders of open positions at predetermined times every 8 hours in proportion to the number of open positions held.

- Most recently traded price of bitFlyer Crypto CFD

- Most recently traded price of Lightning Spot (BTC/JPY)

- Money exchanged between holders of open positions at a predetermined time every 8 hours.

The transfer (collection or grant) of the amount calculated based on the funding rate will be conducted as follows, and the transferred amount will be reflected in the amount that is transferred at the time of settlement of an open position.

The transfer (collection or grant) of the amount calculated based on the funding rate will be conducted as follows, and the transferred amount will be reflected in the amount that is transferred at the time of settlement of an open position. If the open position is held by bitFlyer's proprietary trading department, bitFlyer will also be subject to the collection or grant.

Exchange of calculated amounts based on funding rates

The amount transferred based on the funding rate is calculated as follows.

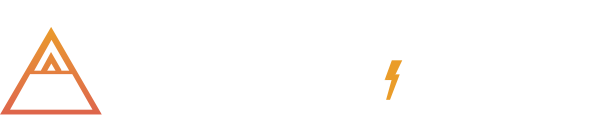

Calculation of funding rate exchange rate

The deviation rates per minute (see below) are calculated. Then, the funding rate exchange rate is calculated as the simple average of the deviation rates per minute for the most recent 8 hours at the following times on each business day.

- (1) 6:00 a.m., (2) 2:00 p.m., and (3) 10:00 p.m. (Japan time) (3 times per business day in total)

The funding rate exchange rate includes the following factors, which are also taken into account (See "Supplemental information on funding rate exchange rate" below.)

- Upper limit of funding rate exchange rate

- The interval where the funding rate exchange rate is constant as the minimum exchange rate

Calculation of funding rate exchange amount

Funding rate exchange amount = A × B × C

- A: Funding rate exchange rate

- B: Number of open positions held by the customer at the time of payment/collection of funding rate exchange amount

- C: Most recently traded spot price of crypto asset at the time of calculation

Definition of deviation rate per minute

The indicative price of either the impact ask price or the impact bid price of bitFlyer Crypto CFD, whichever is closer to the most recently traded spot price ÷ the most recently traded spot price - 100%. If the most recently traded spot price is between the impact ask price and the impact bid price, the price per minute rate is set to zero.

Definition of impact ask price

The assumed volume-weighted average execution price of a bitFlyer Crypto CFD trade that would be executed if a buyer were to buy 1 BTC-CFD's worth of bitFlyer Crypto CFDs, assuming the order conditions of bitFlyer Crypto CFDs at the time the deviation rate per minute is calculated.

Definition of impact bid price

The assumed volume-weighted average execution price of a bitFlyer Crypto CFD trade that would be executed if a buyer were to sell 1 BTC-CFD's worth of bitFlyer Crypto CFDs, assuming the order conditions of bitFlyer Crypto CFDs at the time the deviation rate per minute is calculated.

Upper limit of funding rate exchange rate

Upper limit of simple average funding rate exchange rate: 0.375% (absolute value of ±0.375%)

- The upper limit may be subject to change based on market trends.

Interval of fixed funding rate exchange rate

When the average deviation is between -0.040% and +0.060%, the funding rate exchange rate is always fixed at 0.010% as the minimum exchange rate.

- Always collected from holders of open buy positions and granted to holders of open sell positions.

The relationship between funding rate and price divergence (average divergence) is shown below:

Calculation of the funding rate exchange rate and when it is granted and collected

There is an 8-hour difference between the timing of execution of the following two items, and the specific schedule is as follows. - Calculation of funding rate and publication on the service - Transfer of funding rate amount between holders of open positions (collection or grant)

7. Maintenance Margin Rules, Margin Call Rules, Sell Out Rules

The rules for margin trading (Maintenance Margin Rules, Margin Call Rules, and Sell Out Rules) after the change are as follows.

Maintenance Margin Rules

- If the maintenance margin rate falls below 100%, the Maintenance Margin Rules will apply.

- All outstanding new orders will be revoked (cancelled) ("New orders" shall mean the orders which increase the customer's position.)

- When the maintenance margin rate is below 100%, transferring out your margin deposit from your margin accounts (Japanese yen and Bitcoin) to spot accounts, or placing new orders will be suspended.

- There may be delays in the Maintenance Margin Rules being applied. The Company will not be held liable for any losses incurred as a result of such delays.

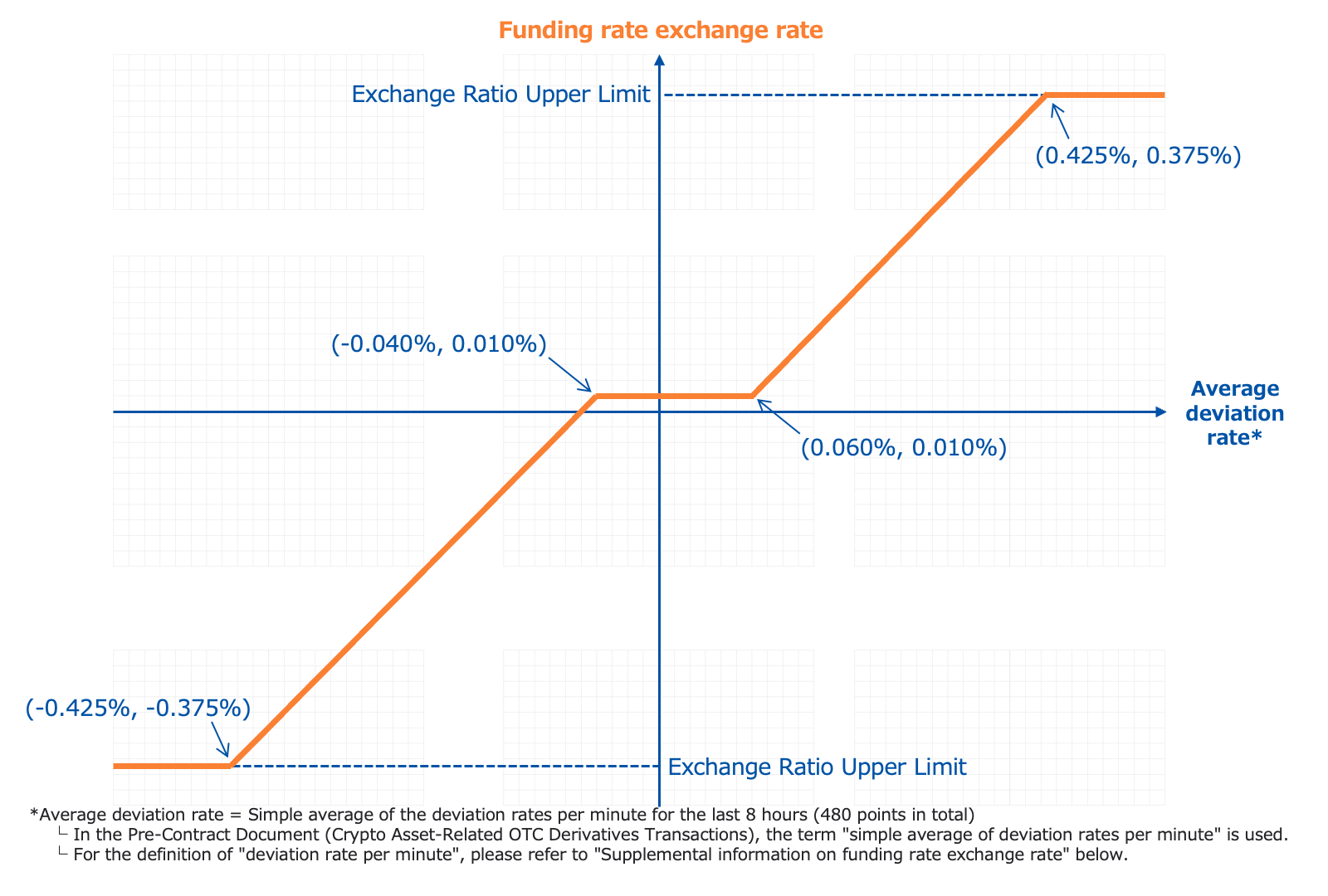

Margin Call Rules

The Margin Call Rules are as follows:

-

If the margin maintenance ratio falls below 100% at 6:00 pm (JST) on any business day (this condition is referred to as "Margin Shortfall"), bitFlyer will request the customer to deposit an additional margin amount to make up for the shortfall to 100%. At this time, the margin maintenance ratio is calculated according to the following formula. (The "Gains and Losses" in the numerator includes unrealized leverage point losses and unrealized funding rate gains/losses).

Margin maintenance rate=Deposit Margin Amount+P&L calculated from the difference between the average contract price and the most recently traded price of bitFlyer Crypto CFD open interest×Held Position

Last Traded Price executed in Lightning Spot×Held Position×Margin Ratio -

All outstanding new orders will be revoked (cancelled).

-

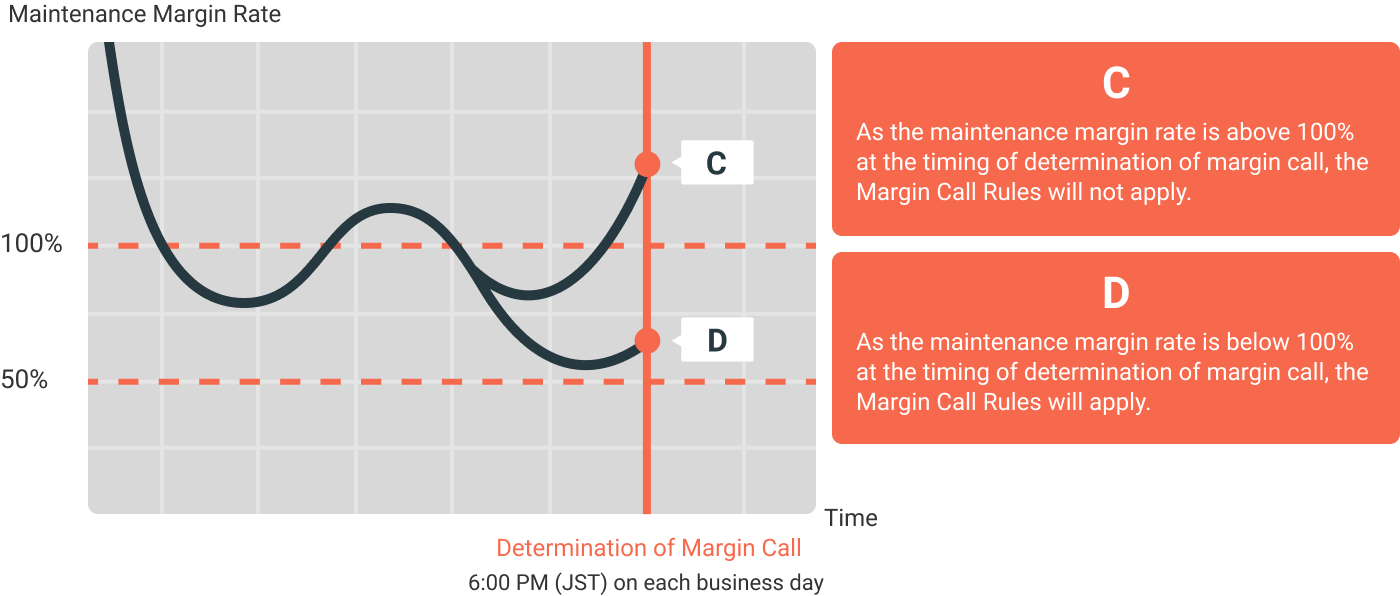

If the margin call has not been resolved by 4:59 PM (JST) on the next business day (including weekends and holidays) after the margin call is triggered, Sell Out Rules will apply at 5:00 PM (JST). The methods of resolving the margin call are as follows:

- Deposit Japanese yen or Bitcoin into your margin account

- Partial or complete settlement of your positions

- Increase the leverage rate

- If the leverage rate is set lower than the maximum value, it can be raised to resolve the margin call. It will not be raised if you have selected the maximum leverage rate.

- Please note that even if the maintenance margin rate exceeds 100% by methods other than listed above (market fluctuation, etc.), after the margin call is triggered, the margin call will not be resolved.

- If the market has changed abruptly, the Sell Out Rules is applied before the Margin Call Rules are applied.

- There may be delays in the Margin Call rules being applied. The Company will not be held liable for any losses incurred as a result of such delays.

Sell Out Rules

The sell out rule is applied under two conditions: when the margin maintenance ratio falls to 50%, or if a margin shortfall identified under the margin call rule is not rectified by 4:59 pm (JST) on the following business day, leading to application of the sell out rule at 5:00 pm (JST).

For the circumstances above where the margin maintenance ratio falls to 50%, the margin maintenance ratio is calculated according to the following formula. (The "Gains and Losses" in the numerator includes unsettled leverage point losses and unsettled funding rate gains/losses). bitFlyer continuously recalculates the margin maintenance ratio. As a result, the margin maintenance ratio fluctuates with changes in both the most recent trading price on bitFlyer Crypto CFD and the most recent spot trading price established on Lightning Spot for the crypto asset referenced by bitFlyer Crypto CFD.

The Sell Out Rules are as follows:

-

If the additional margin incurred on the previous day is not cleared at 5:00 pm JST, in accordance with the Margin Call Rules,

- The Company will close all open positions on bitFlyer Crypto CFD (Sell Out order).

- Sell Out orders are placed as market orders to settle all open positions

- Trade may not be resumed until settlement orders on all positions are finalized.

-

If the maintenance margin rate falls and reaches 50%, the open positions on bitFlyer Crypto CFD will be automatically resold or repurchased in the following order to recover the maintenance margin rate to over 50% (sell out order).

- All sell out orders are executed as market orders.

- Trade may not be resumed until all sell out orders are executed.

- In the event of sudden market fluctuations, losses may exceed the amount of margin even if sell out rules are applied. In such cases, customers are required to promptly allocate cash or cryptographic assets to eliminate the shortfall. In the event of a shortfall, the sending of bitcoin, withdrawal of Japanese yen, and use of bitWire(β) will be suspended. If the customer is unable to deposit more cash than the amount of the shortfall, the Company may, at its discretion, transfer funds from the customer's bitFlyer account to the customer's margin account. In such cases, if it is necessary to allocate the insufficient amount, the Company may, at its discretion, cancel instructions to withdraw money or send cryptographic assets from the customer's bitFlyer account, cancel orders, dispose of assets such as cryptographic assets in deposited with the Company, or allocate the money deposited by the customer, including the consideration for disposal, to the repayment of obligations owed by the customer to the Company. The Company shall not be liable for any losses incurred as a result of such disposal.

- There may be delays in the Sell Out Rules being applied. The Company will not be held liable for any losses incurred as a result of such delays.

8. Transfer Payments (inward and outward) for Margins

-

Transfer in (Spot account to margin account)

- Transfers in can be made 24 hours a day, 365 days a year.

- Deposit margins will be increased as soon as transfer is completed

- Transfers can be made within the range of the transferable amount in your bitFlyer account.

-

Transfer out (Margin account to Spot account)

- Transfers out can be made 24 hours a day, 365 days a year

- Margin Deposit will be decreased as soon as transfer is completed.

- Transfers can be made within the range of the transferable amount in the customer's margin account.

Transfer Times

As a rule, transfers can be made 24 hours a day, 365 days a year. However, the following times are excluded:

- During system maintenance

Deposits cannot be made directly from a financial institution account to a margin account, nor can withdrawals be made from a margin account to a financial institution account.

9. Limitations on Order Volume and Position Holdings

For details on the maximum and minimum order sizes, as well as the limits on the number of positions that can be held, please consult the following table.

| Reference index | Unit | Minimum Order Size | Maximum Order Size | Maximum Held Position Limit |

|---|---|---|---|---|

| BTC-CFD/JPY | BTC-CFD | 0.001 | 100 | 500 |